Powerful Features to Maximise Your Tax Savings

From Tax-Saving Strategies to Tax Relief Claim

Key Features

- Optimised Tax-Saving Strategies

- Personalised Guidance Tailored to Your Financial Goals

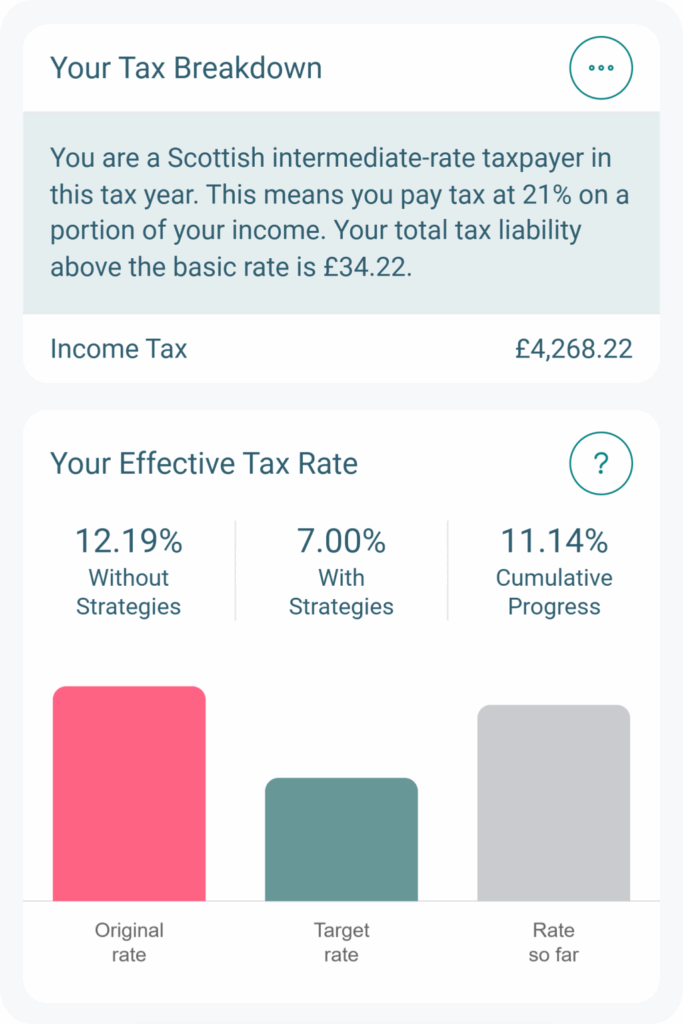

- Monthly Progress Tracking

- Detailed Deductions Breakdown

- Effective Tax Rate Determination

- Support for Multiple Tax Years

- Personalised HMRC Letters for Tax Relief Claims

- Comprehensive Tax Learning Guide

- Report Generation

Powerful Tools to Explore UK Tax Reliefs

Learn about reliefs and eligible claims

Track Progress Monthly

Keep an eye on your tax reliefs with simple monthly summaries. See how much you’ve saved so far, spot trends, and stay motivated.

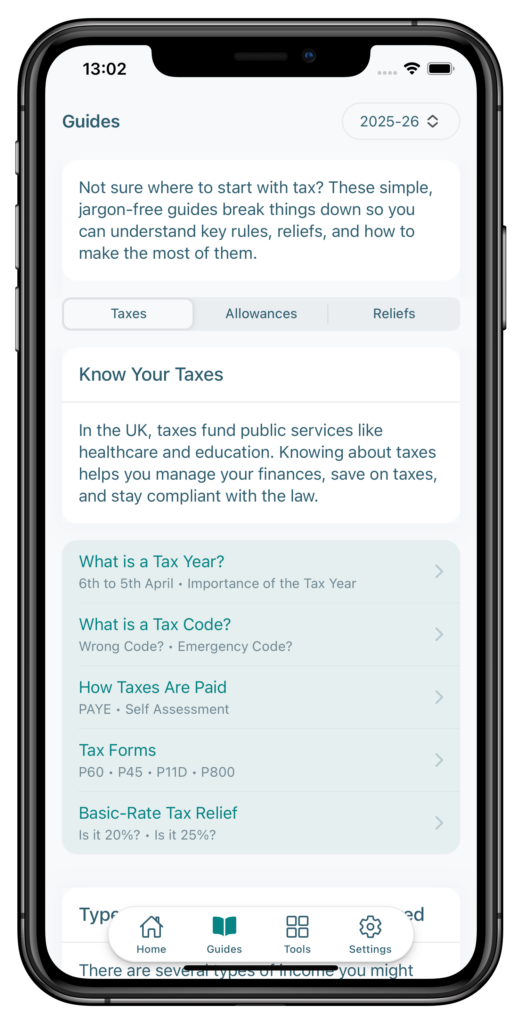

Tax Guides & Glossary

Understand the UK tax system without the jargon. Bite-sized guides for self-assessment, expenses, property income, and more.

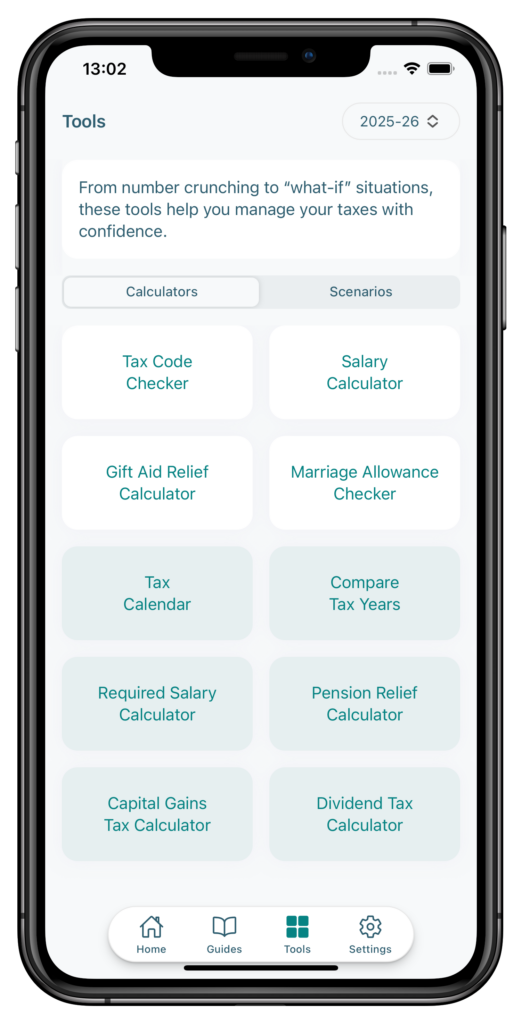

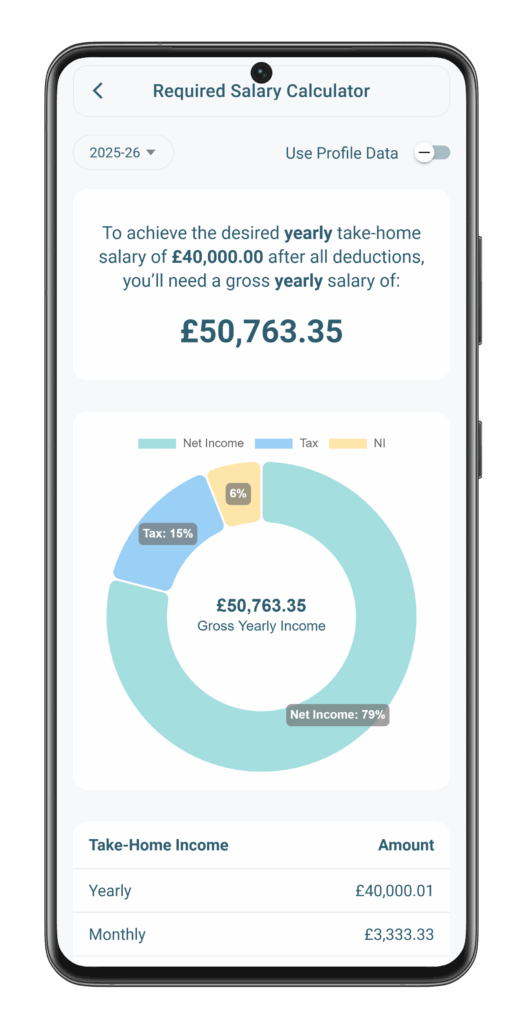

Smart Tax Tools

Plan smarter with quick, easy, HMRC-aligned tools—from salary and tax calculators to CGT, pension relief, dividends, and more.

3 simple steps to explore tax reliefs with SavingTax

Add Your Details

Securely add your income and financial goals — no sensitive bank logins required

See Your Tax Relief Options

Based on current HMRC tax bands and allowances

Track & Stay on Target

Monitor your contributions and tax relief progress monthly

Why Choose SavingTax?

Maximise Tax Savings with Easy-to-Use Tools

HMRC-Aligned

Calculations

We stay up to date with HMRC’s latest tax rules and thresholds, so the information you see reflects current guidance and helps you stay informed.

Secure Data

Handling

We use strong encryption and strict privacy practices to protect your information. Data is only shared when you give clear permission.

Compatible with All

Income Types

No matter how you earn—PAYE, self‑employed, property, or side gigs—SavingTax helps you explore UK tax reliefs that may be relevant to your situation.

Transparent Pricing

Clear, Fair Pricing — No Surprises, Just Savings

Free

PlanPremium

PlanPro

PlanGet started in the app — download below

Ready to Save on Taxes?

Download SavingTax today and understand your UK tax with confidence

Not sure yet? Take our anonymous Tax Reliefs Quiz to explore which reliefs could be relevant to you — no sign‑up required

Frequently Asked Questions

Got Questions? We've Got Answers

Pricing & Features

Yes, the app is free to download and use, offering many features at no cost. However, to unlock premium or pro features, a subscription is required.

With the free version, you can calculate your tax liability, explore tax-saving strategies, explore tax education content, and access basic tax calculators. For advanced features, you can upgrade to the premium version.

The premium version allows you to track your progress toward reducing your tax liability and access advanced tax calculators to help you optimise your tax relief efforts.

Yes, you can cancel your premium or pro subscription at any time. After cancellation, you’ll continue to have access to premium or pro features until the end of your current billing cycle.

Income Type & Taxes

Yes, SavingTax provides tax-saving strategies for both salaried employees and self-employed individuals, helping you make the most of tax relief opportunities.

SavingTax focuses on earned income tax, savings interest tax, capital gains tax, dividend tax, and reliefs like Gift Aid. It also helps you with tax-saving strategies for pensions and charitable donations. However, for specialised taxes like inheritance tax, you may need separate guidance or advice.

Yes, SavingTax allows you to track your pension contributions and shows how they impact your tax liability, ensuring you take full advantage of available tax reliefs.

Yes, SavingTax is designed to handle various income sources in determining your tax liabilities, including salary, self-employment profit, rental income, savings interest, dividends, capital gains.

Yes, SavingTax takes student loan repayments into account when calculating your tax liability and guiding on potential tax-saving strategies.

Data Privacy

Yes, your data is encrypted and stored securely. We follow strict data protection protocols to ensure your financial information is safe and private. Visit our privacy policy page to learn more.

We are fully compliant with GDPR and other data protection regulations. Your financial data is encrypted and stored securely to protect your privacy. Visit our privacy policy page to learn more.

Support

SavingTax is regularly updated to reflect changes in UK tax laws. This ensures you always have the latest information and can take advantage of any new tax reliefs or benefits.

You can reach our support team through the Help section of the app, where you can submit inquiries or find answers to common questions in our knowledge base.

SavingTax is designed specifically for UK taxpayers. If you live abroad or are subject to different tax laws, the app may not offer the most relevant guidance.